Building Financial Freedom: Strategies for Effective Wealth Management

| Event Name: Building Financial Freedom: Strategies for Effective Wealth Management | Event Date: April 4th, 2025 |

| Faculty Coordinators: Dr. Puja Agrawal | Event Timings: 11:00 AM |

| Number of Participants: 67 | Venue: Lloyd Business School, Greater Noida |

Objectives:

The main objective of this expert talk was to enhance students’ understanding of financial planning, investment strategies, and long-term wealth creation. Organized by the Money Lover’s Finance Club, Lloyd Group of Institutions, the session aimed to equip learners with practical insights into managing personal finances, understanding market-linked investments, and building financial independence. Another key objective was to expose students to realworld financial strategies used by industry professionals, enabling them to align their academic knowledge with practical wealth management skills.

Detailed Report:

Money Lover’s Finance Club of Lloyd Group of Institutions organized an insightful expert talk on “Building Financial Freedom: Strategies for Effective Wealth Management”, featuring Mr. Ankur Handa, Sr. Vice-President & Regional Head, UTI AMC. The session provided students with a deep understanding of the principles of wealth management, financial discipline, and investment awareness.

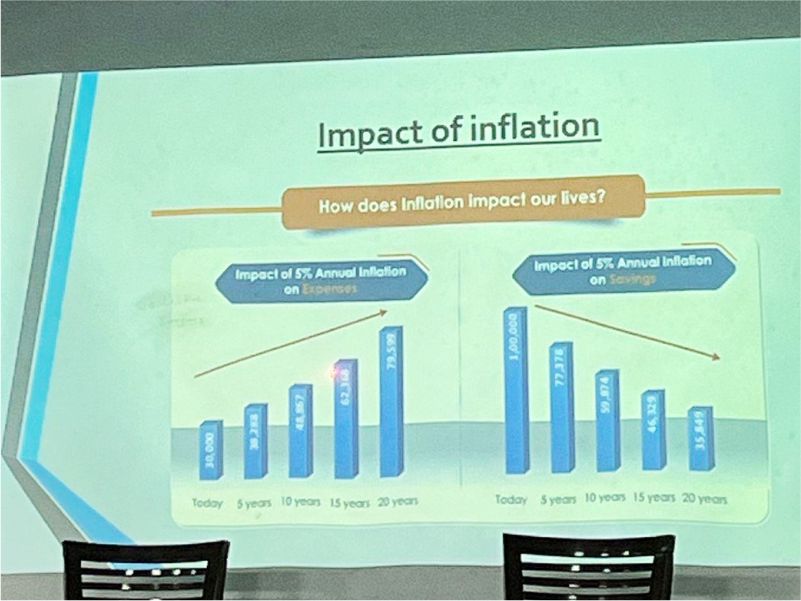

Mr. Handa began the session by discussing the concept of financial freedom and why it is essential in today’s economic environment. He emphasized the importance of early financial planning, disciplined saving habits, and identifying individual financial goals. He explained various financial instruments such as mutual funds, SIPs, equity investments, and debt funds, highlighting how each plays a role in building a diversified portfolio.

Through real-life examples and market scenarios, Mr. Handa demonstrated how compounding works, how risk can be managed through asset allocation, and why long-term investing is crucial for wealth creation. He also shed light on common mistakes young earners make—such as impulse spending, lack of budgeting, and ignoring tax planning—and provided actionable solutions for avoiding them.

Students gained insights into market trends, practical investment approaches, and the importance of financial literacy. The session was interactive, with students actively participating, asking questions, and seeking personalized advice on their financial journeys. Mr. Handa’s expertise provided clarity on how to start investing early, create financial buffers, and manage wealth sustainably.

Learning Outcomes:

The expert talk helped students develop a strong understanding of the fundamental concepts of wealth management and financial independence. They learned how to set realistic financial goals, understand risk-return trade-offs, and choose appropriate investment options. The session enhanced their awareness of personal finance tools such as budgeting, SIPs, mutual funds, and systematic wealth-building plans. Students also recognized the importance of financial discipline, diversification, and long-term thinking. Overall, the session strengthened their financial decision-making abilities and motivated them to begin their journey toward financial security.

Prepared by:

Mr. Ankur Handa